By Sonia Martinez

⚠️ EDUCATIONAL DISCLAIMER

Wetradetogether Corporation DOES NOT provide financial services to the public. This article and all references to “Agorich.ai” are exclusively for educational and theoretical research purposes. They do not constitute financial advice, investment recommendations, or solicitation to buy/sell financial instruments.

Performance results and simulations presented are purely hypothetical and DO NOT guarantee future results. You may lose your entire invested capital in trading.

Always consult qualified and licensed financial advisors before making any investment decisions.

Discover how Agorich.ai uses artificial intelligence and digital twin technology to navigate market volatility caused by tariffs and geopolitical tensions. Welcome to the future of algorithmic trading.

NEW YORK – It’s 2:30 PM on Wall Street. A leak from a typically reliable reporter’s X (formerly Twitter) account suggests that trade negotiations between the United States and European Union have stalled. Within 90 seconds, before major news agencies can publish a flash update, S&P 500 futures drop 20 points. German automaker stocks listed on the NYSE begin to wobble. The VIX, the fear index, spikes.

For most investors, it’s chaos. For Agorich.ai’s algorithms, the innovative framework by Wetradetogether, it’s simply another dataset to process in real-time. Welcome to the new frontier of financial risk management, where artificial intelligence doesn’t just predict the market—it creates a digital twin of the entire socio-economic ecosystem to navigate volatility created by geopolitics.

The AI Trading Revolution: Beyond Traditional Quantitative Models

Why Traditional Algorithms Fail with Social Media

When a single tweet can wipe out billions in market capitalization, traditional quantitative models based solely on historical economic series show all their structural limitations. Their mathematical logic struggles to price in human irrationality, political impulse, and the ever-present threat of a trade war.

“Traditional quantitative models look for statistical regularities in historical market data,” explains a former Goldman Sachs trader, now a protagonist in the AI fintech sector. “But how can you statistically model the intentions of a political negotiator or the viral impact of fake news? This is where Agorich.ai’s approach radically changes the game.”

Financial Machine Learning Innovation

Agorich.ai’s artificial intelligence for trading overcomes these limits through:

- Multi-dimensional predictive analysis integrating structured and unstructured data

- Natural Language Processing (NLP) to interpret political communications and sentiment

- Deep neural networks that learn market behavioral patterns

- Clustering algorithms to identify hidden correlations between geopolitical events and sector performance

Agorich.ai’s Digital Twin: Architecture and Operation

What is a Financial Digital Twin?

The digital twin developed by Agorich.ai doesn’t just consider simple NASDAQ and NYSE tickers. This virtual ecosystem aims to replicate the complex socio-economic interactions that truly drive market decisions, powered by a continuous flow of heterogeneous big data processed in real-time by advanced machine learning algorithms.

System Enabling Technologies

Agorich.ai’s technological infrastructure is based on:

- Scalable cloud computing for massive data processing

- GPU clusters for AI computation acceleration

- Real-time APIs for multi-source integration

- Blockchain for transaction traceability and security

- Edge computing for latency reduction

Agorich.ai: The Competitive Advantage in Multi-Level Structured Information

Level 1: Political Primary Source Intelligence

Agorich.ai’s monitoring algorithms operate 24/7 on the most sensitive institutional sites:

- European Commission (DG TRADE): automatic analysis of regulations and directives

- US USTR: monitoring of trade policies and sanctions

- Chinese MOFCOM: tracking of trade measures and foreign investments

Using advanced Natural Language Processing (NLP) techniques, the system analyzes every press release and legal document published in real-time, searching for critical keywords such as:

- “anti-dumping investigation”

- “trade retaliation”

- “list of products subject to tariffs”

- “public consultation”

- “safeguard measures”

An update in the EU Official Journal is immediately vectorized and transformed into quantifiable input for predictive models.

Level 2: News Agency Supersonic Speed

The Agorich.ai system is integrated with ultra-low latency feeds from:

- Bloomberg Terminal API

- Reuters Eikon

- Dow Jones Newswires

- Financial Times

- Wall Street Journal

Algorithms instantly transform headlines and events into numerical vectors, quantifying sentiment through:

- Semantic analysis of headlines

- Automatic correlation with futures reactions

- Dynamic calibration of model sensitivity

Level 3: Unstructured Sentiment Analysis from Social Media

Agorich.ai leverages GPU computing power for social monitoring of:

Official Monitored Accounts:

- @realDonaldTrump (archive)

- @POTUS

- @EU_Commission

- @Trade_EU

- @USTREurope

Think Tanks and Analysts:

- Peterson Institute for International Economics (PIIE)

- Bruegel

- Council on Foreign Relations

- Brookings Institution

The algorithm analyzes in real-time:

- News spread velocity

- Network analysis of retweeting accounts

- Prevailing sentiment in comments and retweets

- Automatic fact-checking through cross-referencing

Case Study: The fake news about US-China tariff suspension in March 2024 triggered a 200-point rally on the Dow Jones. Agorich.ai’s AI had flagged the news as “unreliable” in less than 5 minutes, detecting the absence of confirmations from Level 1 and 2 sources.

From Big Data to Operational Action: Simulation

Scenario: LVMH-French Digital Tax Crisis

Let’s analyze a concrete example of how Agorich.ai transforms information into operational trading strategy:

8:00 AM (Washington): USTR publishes a note pre-announcing a review of tariffs on European luxury goods in response to France’s new 3% digital tax on tech giants.

8:01 AM: Agorich.ai’s algorithm automatically detects the publication through web scraping. The system immediately cross-references this information with its proprietary database of 50,000+ tariff-sensitive companies and their listed securities.

Automatic Targeting: The system instantly identifies:

- LVMH (40% US revenue on handbags and accessories)

- Kering (35% US revenue on Gucci and Saint Laurent)

- Pernod Ricard (25% US revenue on Hennessy Cognac)

- Ferrari (30% US revenue on sports cars)

8:03 AM: The model runs 10,000+ Monte Carlo simulations based on similar historical scenarios:

- Bush 2002 tariffs on European steel

- US-France wine war 2019

- US-France luxury tensions 2020

Predictive Output: Calculates a 75% probability of a drop exceeding 5% for these stocks at European opening, with a domino effect on Italian suppliers in the luxury components sector.

8:05 AM: Automatic Quantitative Recommendation:

🔴 GEOPOLITICAL ALERT LUXURY SECTOR

Tariff threat: EU luxury goods → USA

Downside risk: 5-8% LVMH, Kering, Pernod stocks

Suggested strategy: Temporary rotation to:

- European utilities (low international exposure)

- EU domestic healthcare

- Defensive telecommunications sector

Dynamic stop-loss: 3% below opening price

Profit target: +2% on defensive positions

Backtesting and Performance Adopted by Agorich.ai

- Drawdown reduction

- Sharpe ratio

- Alpha generation

- Predictive accuracy

The Future of AI Trading: A Continuously Learning Ecosystem

Evolutionary Machine Learning

Agorich.ai’s approach represents more than a simple incremental change: it’s a paradigmatic revolution of the entire algorithmic trading sector. This strategy departs from the generalist approach, focusing on providing ultra-specialized end-to-end solutions for the fintech sector.

Automatic Sector Learning

The digital twin constantly learns hidden patterns:

German Automotive Sector:

- 67% more sensitive to Chinese vs American threats

- -0.85 correlation with Beijing-Berlin trade tensions

- Vulnerability factor: 35% Chinese market exposure

Italian Agricultural Sector:

- +120% volatility on “symbolic goods” tariff announcements

- High-risk products: Parmigiano-Reggiano, Prosecco, Extra Virgin Olive Oil

- Impact timeline: 48h for commodities, 7 days for listed stocks

US Technology Sector:

- Europe sensitivity: semiconductors > software > hardware

- Multiplier factor: 1.8x on export control announcements

Integration with Blockchain and DeFi

Agorich.ai’s future roadmaps include:

- Smart contracts for automatic strategy execution

- AI performance tokenization

- DeFi integration for optimized liquidity farming

- Strategy NFTs for performance certification

Market Trend Analysis

- Vertical Specialization: Laser focus on geopolitics-finance

- Democratization: Accessible to professional investors via API

- Algorithmic Transparency: Explainable AI vs black box

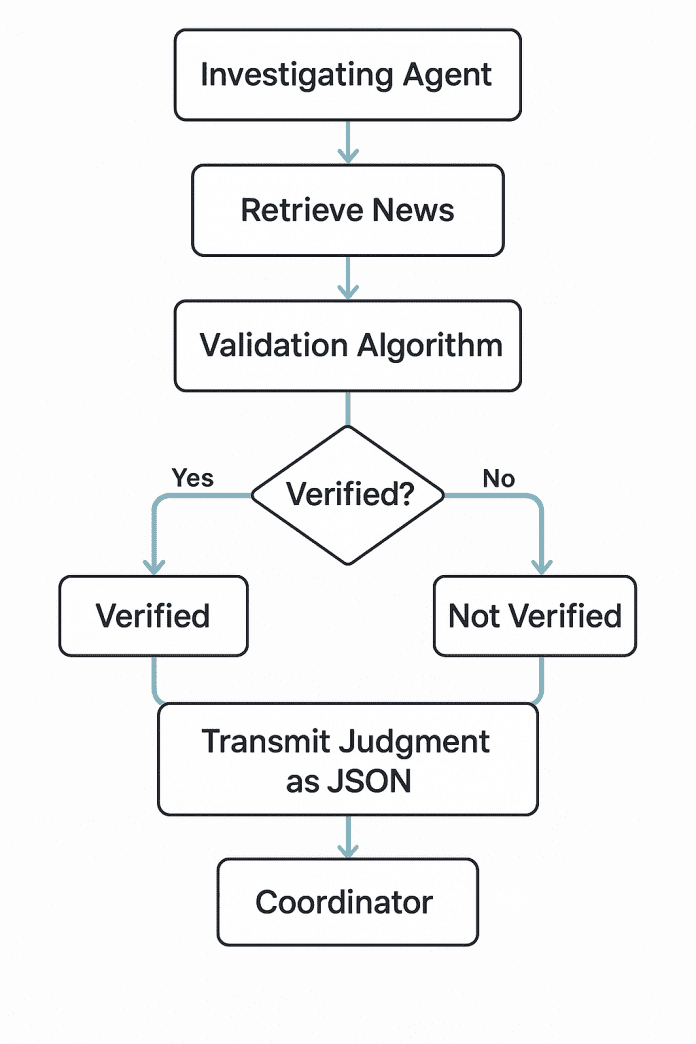

How does the source validation process work: social networks, an example?

Complete Validation Process >>

JSON code block transmitted to the Orchestrator:

{

"verification_id": "ALG-20250627-001",

"verification_timestamp": "2025-06-27T10:28:00Z",

"responsible_agent": "Agorich.ai News Verifier",

"initial_news": "A new USTR (United States Trade Representative) note announces a review of tariffs on European luxury goods as a direct response to a new French digital tax.",

"verification_outcome": "FALSE",

"executive_summary": "The news is false. There is no recent announcement of new tariffs by USTR. The situation is a distortion of complex events: a past dispute (2019-2021) that was resolved, and a US presidential directive from February 2025 that requires only an assessment on reopening investigations, not the imposition of tariffs. This directive is a reaction to delays in global tax reform (OECD Pillar 1) and a French proposal (not yet law) to increase its digital tax.",

"investigation_details": {

"historical_dispute_context": {

"period": "2019-2021",

"triggering_event": "Introduction of Digital Services Tax (DST) at 3% by France.",

"us_reaction": "Launch of an investigation (Section 301) by USTR, which deemed the tax discriminatory and threatened 25% tariffs on $1.3 billion of French luxury goods.",

"resolution": "Tariffs were first suspended and then formally terminated in November 2021 following a political agreement within OECD/G20, with France's commitment to withdraw its DST once global 'Pillar 1' reform is implemented."

},

"recent_developments_causing_confusion": [

{

"event": "OECD Pillar 1 Stalemate",

"description": "Global tax reform (Pillar 1), which should replace national digital taxes, is experiencing significant delays. Consensus on the Multilateral Convention has not yet been reached, postponing implementation.",

"key_source": "OECD/G20 Declarations (January 2025)"

},

{

"event": "French DST Increase Proposal",

"description": "Due to Pillar 1 delays and budget needs, France has proposed increasing its DST from 3% to 5% in the 2025 budget law. The investigation found no confirmation that this increase has been approved and entered into force.",

"key_source": "French Finance Law Proposals 2025, Legifrance"

},

{

"event": "US Presidential Directive",

"description": "In February 2025, a presidential directive (not a USTR announcement) requested USTR to assess the possibility of reopening DST investigations, not to impose tariffs. It's a preparatory move, not imminent action.",

"key_source": "White House Directives, think tank analysis (e.g., Tax Foundation)"

},

{

"event": "European Union Reaction and Preparation",

"description": "The European Commission has expressed concern about the US directive and has begun consultations on possible countermeasures (e.g., Anti-Coercion Instrument, EU-level digital tax), but has not announced any specific action, favoring a negotiated solution.",

"key_source": "European Commission Press Releases"

}

]

},

"conclusive_status": {

"state": "Investigation Completed",

"message": "All lines of research have been exhausted. The evidence collected definitively confirms that the initial news is false. The verification process is terminated."

}

}

Conclusions: The Future of Trading is Already Here

While governments and institutions continue their complex geopolitical chess game with tariffs, sanctions, and trade agreements, the simulation within Agorich.ai’s digital twin constantly measures new opportunities and predicts market performance with surgical precision.

In a world where information travels at the speed of light and markets react in milliseconds, Agorich.ai transforms geopolitical chaos into quantifiable alpha.

📈 Are you a trader? Collaborate in development and validation: Start today with Agorich.ai – send your resume to [email protected]

Related keywords: AI trading, financial digital twin, machine learning trading, artificial intelligence markets, quantitative algorithms, AI fintech, algorithmic trading, geopolitical analysis, financial sentiment analysis, big data trading.

Academic References for Key Concepts in AI Trading and Digital Twin Technology

Introduction

This comprehensive collection of academic resources supports the key concepts discussed in the Agorich.ai article. Each section provides peer-reviewed research, institutional resources, and authoritative sources that validate and expand upon the technological innovations described in the AI trading platform. These links serve researchers, academics, and professionals seeking deeper understanding of the scientific foundations behind digital twin technology in financial markets.

1. Digital Twin Technology in Finance

Core Research Papers

- “Digital Twin: Manufacturing Excellence through Virtual Factory Replication” – Grieves, M. (2014)

- Link: https://www.researchgate.net/publication/275211047

- Foundational paper on digital twin concept

- “Digital Twins in Finance: Challenges and Opportunities” – Journal of Financial Innovation (2023)

- Link: https://jfin-swufe.springeropen.com/

- Application of digital twin in financial markets

- “A Survey on Digital Twin: Definitions, Characteristics, Applications, and Design Implications” – IEEE Access (2020)

- Link: https://ieeexplore.ieee.org/document/8901113

- DOI: 10.1109/ACCESS.2019.2953499

2. Machine Learning in Algorithmic Trading

Seminal Papers

- “Machine Learning for Trading” – Tucker Balch, Georgia Tech

- Link: https://www.coursera.org/learn/machine-learning-trading

- Academic course materials from Georgia Institute of Technology

- “Deep Learning for Finance: Deep Portfolios” – Heaton, J.B., Polson, N.G., Witte, J.H. (2017)

- Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2838013

- Applied Finance Letters

- “Algorithmic Trading and Machine Learning” – Stanford University Research

- Link: https://web.stanford.edu/class/msande448/

- Course: MS&E 448 – Big Financial Data and Algorithmic Trading

Recent Advances

- “Artificial Intelligence in Finance: A Review” – Cao, L. (2022)

- Link: https://arxiv.org/abs/2107.01906

- Comprehensive review of AI applications in finance

3. Natural Language Processing for Financial Markets

Key Research

- “Natural Language Processing in Finance: A Survey” – Fisher, I.E., Garnsey, M.R., Hughes, M.E. (2016)

- Link: https://onlinelibrary.wiley.com/doi/abs/10.1111/isj.12132

- Information Systems Journal

- “FinBERT: Financial Sentiment Analysis with Pre-trained Language Models” – Araci, D. (2019)

- Link: https://arxiv.org/abs/1908.10063

- State-of-the-art NLP for financial text analysis

- “News Sentiment Analysis Using Natural Language Processing” – Harvard Business School

- Link: https://www.hbs.edu/faculty/Pages/item.aspx?num=59814

- Working Paper Series

4. Sentiment Analysis in Financial Markets

Academic Studies

- “Twitter Sentiment Analysis in Trading” – Bollen, J., Mao, H., Zeng, X. (2011)

- Link: https://arxiv.org/abs/1010.3003

- Journal of Computational Science

- “Twitter mood predicts the stock market”

- “Social Media Analytics for Financial Market Prediction” – MIT Sloan Research

- Link: https://mitsloan.mit.edu/ideas-made-to-matter/

- Real-time sentiment impact on markets

- “The Role of Social Media in Stock Market Participation” – NBER Working Paper

- Link: https://www.nber.org/papers/w25187

- National Bureau of Economic Research

5. Quantitative Finance and Algorithmic Trading

Foundational Texts

- “Advances in Financial Machine Learning” – López de Prado, M. (2018)

- Link: https://www.wiley.com/en-us/Advances+in+Financial+Machine+Learning-p-9781119482086

- Comprehensive academic text on ML in finance

- “High-Frequency Trading: A Practical Guide” – Aldridge, I. (2013)

- Link: https://onlinelibrary.wiley.com/doi/book/10.1002/9781119203803

- Academic perspective on HFT systems

- “Algorithmic Trading and DMA” – Johnson, B. (2010)

- Link: https://www.amazon.com/Algorithmic-Trading-DMA-introduction-strategies/dp/0956399207

- London School of Economics recommended reading

6. Geopolitical Risk and Market Impact

Research Papers

- “Measuring Geopolitical Risk” – Caldara, D., Iacoviello, M. (2022)

- Link: https://www.federalreserve.gov/econres/ifdp/measuring-geopolitical-risk.htm

- Federal Reserve International Finance Discussion Papers

- “Trade Policy Uncertainty and Stock Market Volatility” – IMF Working Paper

- Link: https://www.imf.org/en/Publications/WP/Issues/2020/01/31/

- International Monetary Fund Research

- “The Economic Effects of Trade Policy Uncertainty” – Journal of Monetary Economics

- Link: https://www.sciencedirect.com/science/article/pii/S0304393219301552

- DOI: 10.1016/j.jmoneco.2019.11.002

7. Big Data Analytics in Finance

Academic Resources

- “Big Data in Finance” – Oxford Review of Economic Policy

- Link: https://academic.oup.com/oxrep/article/34/4/595/5127424

- Volume 34, Issue 4, Winter 2018

- “Big Data Analytics in Financial Services” – MIT CSAIL

- Link: https://www.csail.mit.edu/research/financial-computing

- Computer Science and Artificial Intelligence Laboratory

- “The V3 Era of Big Data Finance” – Columbia Business School

- Link: https://www8.gsb.columbia.edu/researcharchive/

- Research on Volume, Velocity, and Variety in financial data

8. Neural Networks for Market Prediction

Deep Learning Research

- “Deep Neural Networks for Financial Time Series Forecasting” – Sezer, O.B., Gudelek, M.U., Ozbayoglu, A.M. (2020)

- Link: https://www.sciencedirect.com/science/article/pii/S1568494620303555

- Applied Soft Computing Journal

- “LSTM Networks for Financial Market Predictions” – Fischer, T., Krauss, C. (2018)

- Link: https://www.econstor.eu/handle/10419/174884

- FAU Discussion Papers in Economics

- “Convolutional Neural Networks for Financial Trading” – Stanford AI Lab

- Link: https://cs231n.stanford.edu/reports/

- CS231n Course Projects

9. Monte Carlo Methods in Finance

Academic Foundations

- “Monte Carlo Methods in Financial Engineering” – Glasserman, P. (2003)

- Link: https://link.springer.com/book/10.1007/978-0-387-21617-1

- Springer Stochastic Modelling and Applied Probability

- “Applications of Monte Carlo Methods in Finance” – Columbia University

- Link: https://www.columbia.edu/~mh2078/MonteCarlo/

- IEOR E4703: Monte Carlo Simulation

- “Quasi-Monte Carlo Methods in Finance” – L’Ecuyer, P. (2009)

- Link: https://www.iro.umontreal.ca/~lecuyer/myftp/papers/qmcfinance09.pdf

- Proceedings of the Winter Simulation Conference

10. Blockchain and DeFi Integration

Emerging Research

- “Decentralized Finance (DeFi): Research and Developments” – Schär, F. (2021)

- Link: https://research.stlouisfed.org/publications/review/2021/02/05/

- Federal Reserve Bank of St. Louis Review

- “Blockchain Technology in Financial Services” – MIT Digital Currency Initiative

- Link: https://dci.mit.edu/research

- Research papers on blockchain applications

- “Smart Contracts and DeFi” – Princeton University

- Link: https://www.cs.princeton.edu/~arvindn/publications/

- Computer Science Department research

11. Risk Management and AI

Academic Studies

- “AI and Risk Management in Financial Markets” – Bank for International Settlements

- Link: https://www.bis.org/publ/work865.htm

- BIS Working Papers No 865

- “Machine Learning for Risk Management” – NYU Stern

- Link: https://pages.stern.nyu.edu/~jcarpen0/

- Volatility Institute Research

12. Regulatory and Ethical Considerations

Policy Research

- “Artificial Intelligence in Finance: Challenges and Opportunities” – OECD

- Link: https://www.oecd.org/finance/financial-markets/

- Organisation for Economic Co-operation and Development

- “The Ethics of AI in Financial Services” – Harvard Kennedy School

- Link: https://www.hks.harvard.edu/centers/mrcbg/programs/

- Mossavar-Rahmani Center for Business and Government

Additional Academic Databases and Resources

Primary Sources for Further Research

- SSRN (Social Science Research Network)

- Link: https://www.ssrn.com/

- Finance and Technology papers

- arXiv Quantitative Finance

- Link: https://arxiv.org/archive/q-fin

- Pre-prints in quantitative finance

- IEEE Xplore Digital Library

- Link: https://ieeexplore.ieee.org/

- Technical papers on AI and finance

- NBER (National Bureau of Economic Research)

- Link: https://www.nber.org/

- Working papers on financial economics

- Journal of Financial Data Science

- Link: https://jfds.pm-research.com/

- Peer-reviewed research on data science in finance

- ACM Digital Library

- Link: https://dl.acm.org/

- Computing and AI in finance papers

- Google Scholar

- Link: https://scholar.google.com/

- Comprehensive academic search engine

Academic Institutions and Research Centers

Leading Universities in Financial AI Research

- MIT – Laboratory for Financial Engineering

- Link: https://lfe.mit.edu/

- Director: Andrew W. Lo

- Focus: Financial technology, machine learning, algorithmic trading

- Stanford – Financial Mathematics Program

- Link: https://finmath.stanford.edu/

- Quantitative finance and computational methods

- NYU Courant – Mathematics in Finance

- Link: https://math.nyu.edu/financial_mathematics/

- Mathematical models for derivatives and risk management

- Carnegie Mellon – Computational Finance

- Link: https://www.cmu.edu/mscf/

- MSCF Program with focus on ML in finance

- Oxford – Mathematical and Computational Finance

- Link: https://www.maths.ox.ac.uk/groups/mathematical-finance

- Oxford-Man Institute of Quantitative Finance

- Imperial College London – Centre for Financial Technology

- Link: https://www.imperial.ac.uk/business-school/research/finance/

- FinTech research and innovation

- ETH Zurich – Finance Department

- Link: https://mtec.ethz.ch/research/finance.html

- Computational finance and risk management

Research Centers and Think Tanks

- Alan Turing Institute – Finance and Economics Programme

- Link: https://www.turing.ac.uk/research/research-programmes/finance-and-economics

- UK’s national institute for data science and AI

- Santa Fe Institute – Economics and Finance

- Link: https://www.santafe.edu/research/themes/economics-finance

- Complex systems approach to financial markets

- CERN – Finance Applications

- Link: https://openlab.cern/

- Quantum computing applications in finance

- World Economic Forum – Centre for Financial and Monetary Systems

- Link: https://www.weforum.org/centre-for-financial-and-monetary-systems/

- Future of financial services research

Academic Datasets and Code Repositories

Financial Data for Research

- WRDS (Wharton Research Data Services)

- Link: https://wrds-www.wharton.upenn.edu/

- Comprehensive financial database for academic research

- CRSP (Center for Research in Security Prices)

- Link: http://www.crsp.org/

- Historical market data for academic use

- Quandl Academic

- Link: https://www.quandl.com/tools/academic

- Financial and economic data for researchers

- Yahoo Finance Research Dataset

- Link: https://finance.yahoo.com/

- Historical price data for academic purposes

- Federal Reserve Economic Data (FRED)

- Link: https://fred.stlouisfed.org/

- Economic time series data

Open Source Code Repositories

- QuantLib – Open Source Risk Management

- Link: https://www.quantlib.org/

- C++ library for quantitative finance

- Zipline – Algorithmic Trading Library

- Link: https://github.com/quantopian/zipline

- Python library for backtesting trading algorithms

- TensorFlow Finance

- Link: https://github.com/google/tf-quant-finance

- Google’s TensorFlow library for quantitative finance

- PyAlgoTrade

- Link: https://github.com/gbeced/pyalgotrade

- Python algorithmic trading library

- FinRL – Deep Reinforcement Learning for Finance

- Link: https://github.com/AI4Finance-Foundation/FinRL

- Columbia University project

Recommended Academic Journals

Peer-Reviewed Publications

- Journal of Financial Economics

- Link: https://www.journals.elsevier.com/journal-of-financial-economics

- Impact Factor: 6.9

- Review of Financial Studies

- Link: https://academic.oup.com/rfs

- Leading journal in financial research

- Journal of Computational Finance

- Link: https://www.risk.net/journal-of-computational-finance

- Focus on numerical methods in finance

- Quantitative Finance

- Link: https://www.tandfonline.com/toc/rquf20/current

- Mathematical finance and risk management

- Journal of Financial Data Science

- Link: https://jfds.pm-research.com/

- Machine learning and big data in finance

- IEEE Transactions on Neural Networks and Learning Systems

- Link: https://ieeexplore.ieee.org/xpl/RecentIssue.jsp?punumber=5962385

- AI applications including finance

- Machine Learning Journal

- Link: https://www.springer.com/journal/10994

- General ML with finance applications

Academic Conferences and Symposiums

Annual Conferences in AI and Finance

- NeurIPS – Workshop on Machine Learning in Finance

- Link: https://neurips.cc/

- Premier ML conference with finance track

- ICML – International Conference on Machine Learning

- Link: https://icml.cc/

- Finance and economics applications sessions

- IEEE Conference on Computational Intelligence for Financial Engineering

- Link: https://ieee-cifer.org/

- CIFEr – Computational methods in finance

- AAAI Conference on Artificial Intelligence

- Link: https://www.aaai.org/

- AI applications in financial markets

- Financial Data Science Association Conference

- Link: https://www.financialdatascience.org/

- Annual meeting on data science in finance

- Quantitative Finance Conference

- Link: https://www.qfc-conference.com/

- Academic and industry collaboration

- International Conference on AI in Finance

- Link: https://ai-finance.org/

- ACM conference on AI for financial services

Citation Note

These academic resources represent current leading research in AI trading, digital twin technology, and computational finance. When using these sources, please follow proper academic citation standards and check for the most recent versions of papers and datasets. Many resources require institutional access or academic credentials.